Dear Akropolis Community,

Welcome to the Akropolis monthly roundup! Read on to find out the latest development at Akropolis in July.

While the total DeFi market cap – according to CoinGecko, has reclaimed the $50 billion level, there are still numerous things that need to be built in the space, such as layer 2s, multi-chain aggregation, bridge technology, custody and decentralised autonomous organisations as some of the stuff on the way. The team is committed and determined to deliver real solutions to the DeFi ecosystem, not BUIDLing a 6-months product.

We go through the downturn together, and all come out of it stronger.

We are happy to announce that our Subgraph is now deployed, indexed and ready to serve requests on the decentralised The Graph network. As mentioned in our June monthly roundup, the Akropolis team was working on migrating Akropolis dApp to the Graph Protocol decentralised network, which is a significant upgrade in terms of stability and request processing quality.

Using The Graph Network adds a layer of robustness, security, and reliability to the Akropolis dApp, reducing risk to the dApp’s uptime and user experience.

The Graph’s decentralised network was launched in December 2020 to migrate Web3 dApps to fulfil their mission of building on decentralised infrastructure.

Its smart contracts lay the groundwork for queries to happen without relying on centralised servers but rather on a decentralised network of incentivised contributors. That means that none of the blockchain data queried through its data infrastructure will come from centralised servers. This makes the process of data query virtually impenetrable.

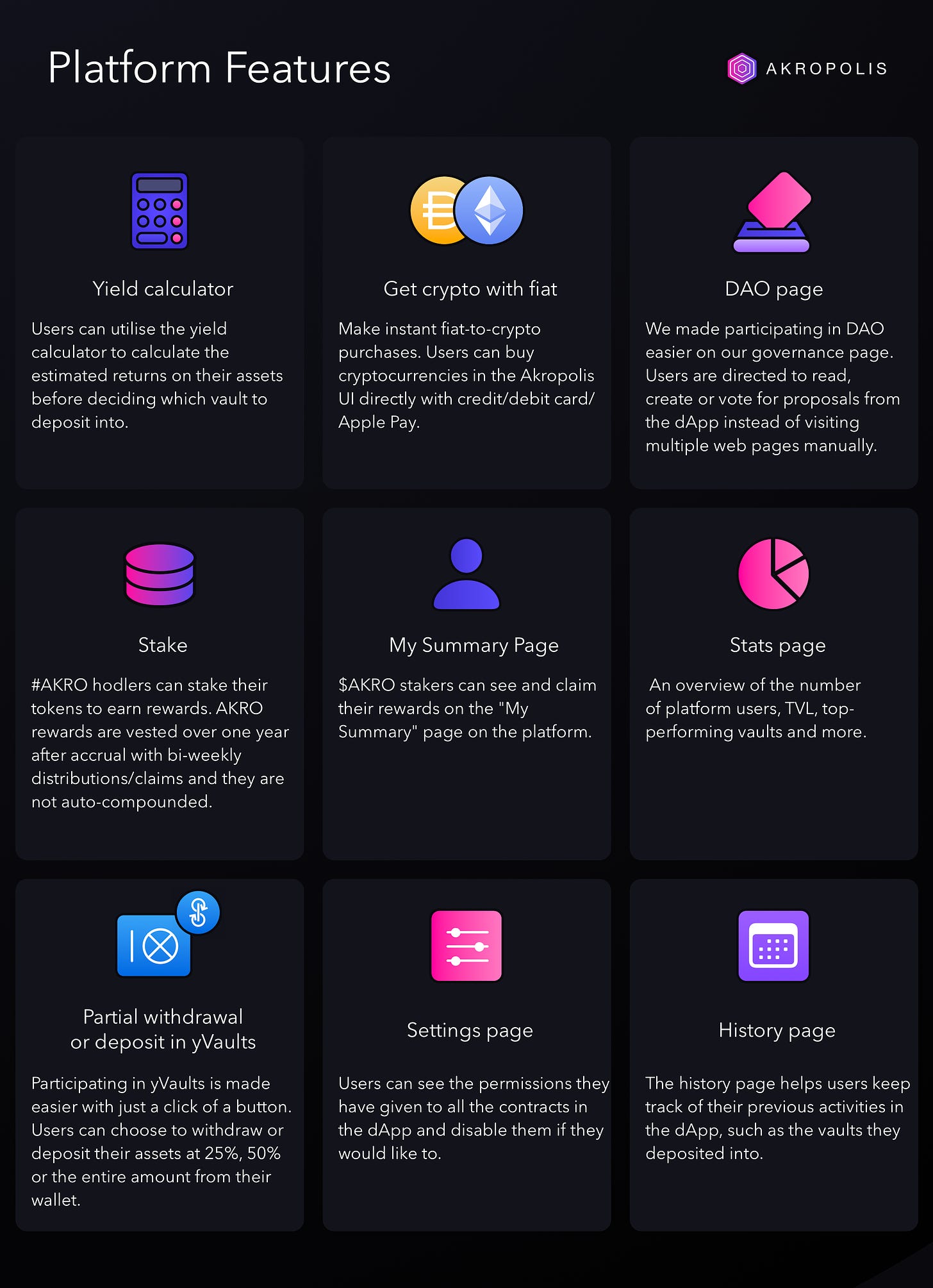

Here is a quick guide to everything you need to know about Akropolis.

If you have difficulty navigating or using our dApp, please let us know in Discord or Telegram. Our friendly community managers will assist you.

About the crypto cycles for the BUIDLers, retail investors and venture investors.

2. Christmas came early? The rate hike ended up bullish.

3. Crypto winter presents an opportunity amid chaos.

That’s all we have for our July Roundup. Got a question? Feel free to reach out to us on our social media channels.

Discord | Telegram | Reddit | Twitter | Medium | Docs | Website

For media and collaboration opportunities, please email team@akropolis.io.