Akropolis Protocol is Live

Security audit, initial product functionality, upcoming features & incentives

June ends just right! The moment we’ve all been waiting for is here. After long days of development and security audits, we are excited to announce that Akropolis protocol has launched on the Ethereum mainnet! Security audit, initial product spec, redesign, liquidity mining incentives, UI/UX enhancements, new products and more in this article.

Important things first — security audit

We’re proud to share that our framework for launching financial DAOs — AkropolisOS — is fully audited by Certik team (feel free to examine the security audit here). TL;DR: potential critical issues are resolved and fixed, all minor bugs are fixed. We will be announcing a bug bounty shortly and welcome any early feedback and feature requests, the most comprehensive feedback and most innovative feature requests will be awarded $1000 in AKRO on a monthly basis.

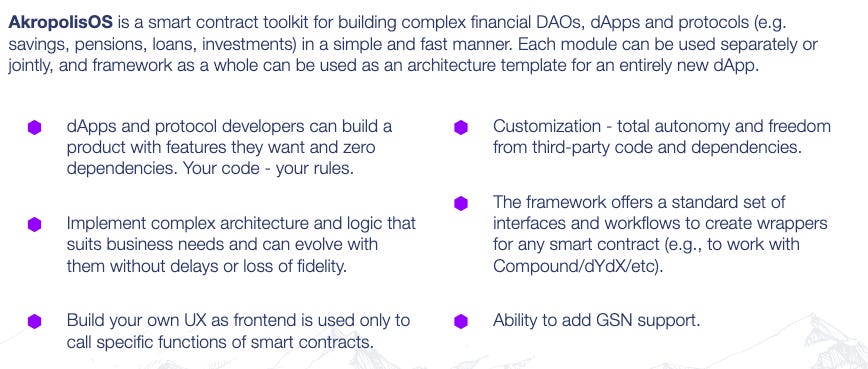

AkropolisOS is an unopinionated, modular and upgradeable framework built with OpenZeppelin SDK and rooted in Facade software design pattern. Aimed at a developer rather than the end-user audience, AkropolisOS empowers developers to quickly set up and collectively manage DAOs with entirely customisable user incentives, automated liquidity provision enabled by the bonding curve mechanism, programmatic liquidity and treasury management. AkropolisOS provides lego-like scalability without the loss of coherence and security during upgrades.

What can you build on AkropolisOS?

We believe in the value of dogfooding, so below are our two DeFi products built on AkropolisIO, that serve to address two important needs:

Sparta — Use Case 1: access to undercollateralised loans;

Delphi— Use Case 2: automated passive investing and income wrapped in one easy to use product.

Combined, they offer two main native DeFi equivalents of core financial services: insurable savings (variable and fixed-rate savings deposits) and access to credit, without reliance on the traditional banking system. Our future work will go some way towards reducing systemic risk in native DeFi products.

Today, however, we focus on the Sparta v0.1 release.

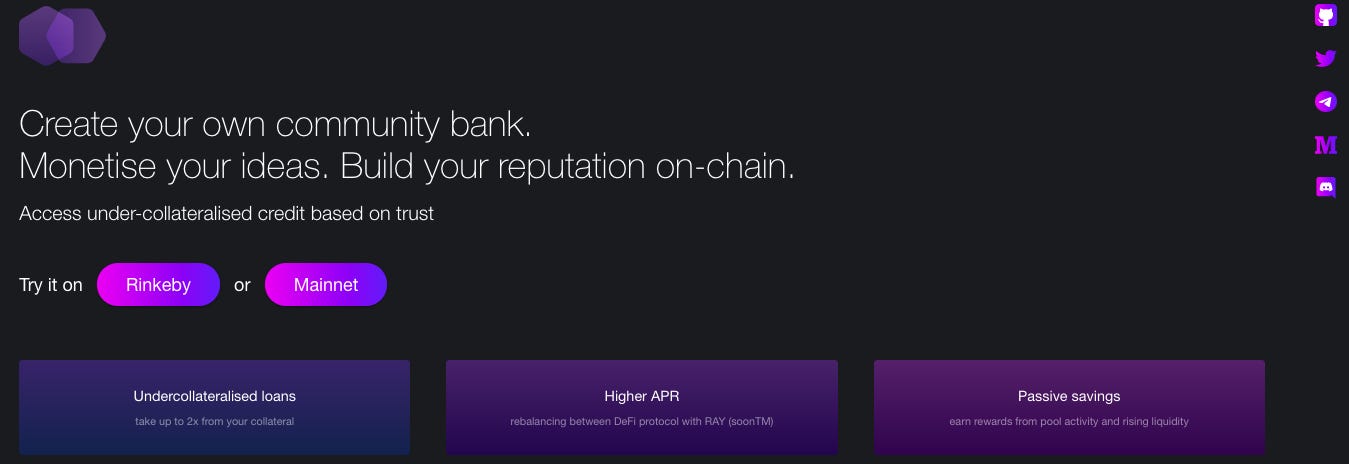

Sparta — What is it and how does it work?

Sparta is the first implementation on AkropolisOS.

Sparta is an Undercollateralised Loans and Savings Pool designed to deliver access to undercollateralised credit, and provide a combination of native yield and “interest rate income” to its members.

We wanted to launch as soon as possible after the audit is completed, so Sparta v0.1 naturally has restricted functionality, with the new UX/UI and integration with an automatic rate rebalancer (RAY<>Curve) coming up.

So what can you do as a Sparta v0.1 user? Things that our members can do:

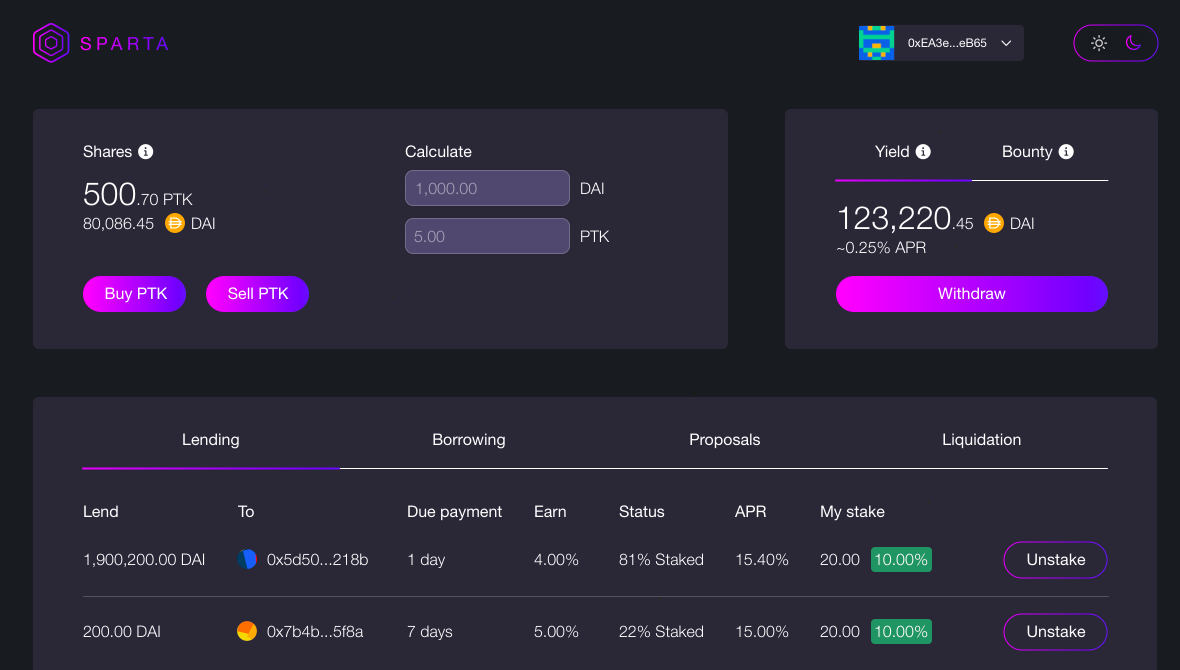

Contribute funds to the pool and hold internal pTokens (pool shares). Their price is determined by the bonding curve and changes as a function of liquidity amount in the pool. It is designed to allow for secondary liquidity management and our version of “ragequit”;

Take out an undercollateralised loans from the pool (providing only 50% of collateral, i.e. 50% LTV or Loan-to-Value);

Lend funds to members of the pool by staking in favour of their loan request and earn higher APR (please remember higher APR reflects higher risk).

All early participation in Sparta v0.1 will be counted towards the forthcoming liquidity mining programme. You can check the FAQ for interacting with the Sparta here.

Keen yield farmers can customise Sparta v0.1 to create a true farming co-operative, with larger farmers backing smaller one’s trading proposals, feeding the loan and trade proceeds into a jointly managed co-op treasury. A word of caution: whilst this is an entirely possible use case, it is high-risk and repayment of the trade proceeds won’t be entirely trustless in this particular use case.

Upcoming updates

Over the next days, we aim to introduce several important features and additions (roadmap here). More on it below:

[in progress] UI/UX enhancement

Any project in DeFi sphere (and Web3 in general) faces a lot of limitations and UI/UX problems. We’re not an exception here — as a lot of other projects, we want to improve user experience and make our Pool as simple as possible to use. As most of the functionality is already there, we have started to work on UI/UX improvements following the latest design trends and in-depth usability tests. We have already redesigned our website (take a look at akropolis.io!) and are now working on the product prototypes — check them out!

[in progress, pending audit] DeFi yield rebalancing module

We want to give users as many incentives to join us as we can — additional passive income is one of them. We have developed a module which utilizes Robo-Advisor for Yield from Staked.Us to rebalance between such protocols as Aave, Compound, dYdX, Fulcrum (disabled atm) to earn higher passive yield. Another part of rebalancing module is Curve.fi which rebalances between different stablecoins to provide higher APR. At the moment, funds will be sent to one of them (based on higher yield after all transaction fees) upon the deposit.

[in progress] Gas Network Station support

We are well aware that one of the big limitations to user adoption is gas fees — you always need to have a small amount of ETH to pay for transactions, and gas price is subject to network load & can skyrocket any time. To solve this problem, we plan to integrate OpenGSN, which allows paying transaction fees in the token which person sends (in our case — in DAI).

[upcoming] Insurance via NexusMutual/Opyn

We all know by now that security audit alone does not guard against security issues and risks that are yet to be discovered as ecosystem evolves. Alongside with bug bounty, we will be offering an opportunity to purchase insurance coverage against hacks & code issues via Nexus Mutual or Opyn.

[upcoming] Governance portal

We’re building Akropolis Protocol with decentralization in mind. To be able to react quickly to any potential issue, Akropolis will keep the ownership of the protocol in this initial launch phase. As a part of the gradual decentralization process, we will be setting up a governance portal where AKRO token holders will be able to vote for different protocol parameters, such as loan & APR sizes, yield sources, bonding curve parameters, etc.

[upcoming] USDT, USDC, RSV stablecoins support

In addition to DAI, we want to add support of different SoV stablecoins to enable passive yield accumulation and loan issuance in various tokens.

In the near future, we will add USDT, USDC and RSV stablecoins to Sparta.